STAR EXEMPTION FACT SHEET

TRS is in the business of saving you money on property taxes, whether it’s filing a grievance for your over-taxed property or simply providing you with important new information.

With that in mind, we wanted to remind you about your eligibility for an additional property tax reduction via the New York State Basic STAR Exemption program. You may have read about this in the news, as it’s an effective, innovative way for homeowners to get relief from their school taxes. (Note: The Enhanced STAR Program remains unchanged.)

Below are the key requirements in regards to eligibility. New York State will be carefully monitoring your qualifications, so please read below before beginning the process:

What is the STAR Exemption?

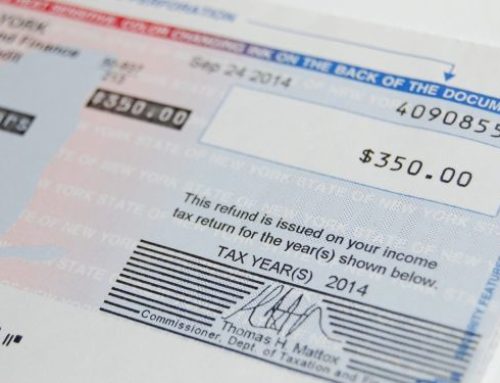

It’s New York State’s School Tax Relief Program, which includes a school property tax rebate program and a partial property tax exemption from school taxes. The STAR program is truly a win/win situation, as your school district gets income tax revenue back from Albany and school taxes are reduced accordingly.

What has changed?

All Eligible homeowners must re-register for the Basic STAR exemption by December 31, 2013 in order to receive their exemption in 2014 and subsequent years. It is a one-time registration, and the tax department will now be monitoring homeowner eligibility in the future so there won’t be a need to reapply.

What do I need to register with New York State?

- The names and social security numbers for all property owners and spouses

- Your STAR code – this can be looked up online at: http://www.tax.ny.gov/pit/property/star13/lookup.htm

(The state is also in the process of mailing the codes to all Basic STAR recipients)

In order to register for the Basic STAR, you must be able to confirm these three things:

- Confirm that the property is the primary residence of one of the owners.

(Married couples with multiple residences may only claim one STAR exemption)

- Confirm that the combined income of the owners and their spouses who reside at the property does not exceed $500,000.

- Confirm that no owner received a residency-based tax benefit from another state.

How can I register?

Online: http://www.tax.ny.gov/pit/property/star13/

By Phone: # (518) 457-2036